Fast, affordable Internet access for all.

The key for states to unlock their portion of the $42.5 billion in federal BEAD funds is the submission and approval of their Five Year Action Plans and Final Proposal. The infrastructure law requires states to first file an action plan, and then prepare more detailed Initial Proposals, allowing residents and stakeholders to submit public comments.

So far, 14 states have filed their Five Year Action Plans with the National Telecommunications and Information Administration (NTIA), the Treasury Department agency in charge of allocating the funds to each state and U.S. territory. According to the NTIA’s website, Maine, Louisiana, Delaware, Georgia, Hawaii, Idaho, Kansas, Montana, North Carolina, Ohio, Oregon, Pennsylvania, Utah, and Vermont have all filed their draft Five Year Action Plans.

The states that are now in the process of completing their Initial Proposals include: Delaware, Kansas, Louisiana, Montana, Ohio, Tennessee, Vermont, Virginia and Wyoming.

Today, we will look at two states (Maine and Louisiana) and follow up with the others as we are getting a clearer picture of how each state intends to put this historic infusion of federal funds to use.

Maine

Maine is poised to receive $271.9 million in BEAD funds to expand broadband access to 42,264 unserved locations–locations that do not have access to 25/3 Megabits per second (Mbps) service and 52,000 underserved locations (locations with access to between 25/3 and 100/20 Mbps service). Those are the official locations the federal government will fund, though there are undoubtedly many others that are not included due to the problems with the FCC’s faulty national broadband map (which we raised alarm bells about back in January along with other public interest organizations, telecom experts, and U.S. Senators).

Still, Maine’s Five Year Action Plan stands out for several reasons. First, the Maine Connectivity Authority (MCA), which will administer the state’s allocation of BEAD grant funds, chose to combine its Five Year Action Plan for BEAD with its Digital Equity Plan–the latter of which is also required for state’s to claim separate funds under the Digital Equity Act (DEA). BEAD and DEA were both passed as part of the Infrastructure Investment and Jobs Act (IIJA) and while NTIA encouraged states to coordinate its BEAD and DEA efforts, Maine opted to put both plans in the same document. Or as MCA officials wrote: “MCA combined them and approached the process as one–developing a Broadband Action Plan rooted in digital equity.”

While most of the Five Year Action Plans from other states use slightly different wording to capture how they intend to “prioritize funding to maximize impact,” address affordability, and “decrease barriers to delivering broadband at scale and speed,” Maine’s plan also stands out in how it defines broadband.

Maine Redefines the Meaning of Broadband

The infrastructure law defines “underserved” locations as those that do not have access to 100/20 Mbps service. But Maine has adopted a more robust definition, having statutorily defined broadband as service that delivers 100/100 Mbps. In Maine’s Five Year Action Plan, MCA notes that the state’s goal is to provide 100/100 Mbps service for all locations “where possible” and in evaluating grant applications, “proposed projects under the BEAD Program that can provide 100/100 Mbps service to un/underserved locations will potentially receive a higher weighting and prioritization.”

With “a rolling funding application process,” MCA is proposing to “center digital equity in infrastructure projects and other programs to prioritize investment impact through an enhanced broadband mapping and analysis platform known as the Connectivity Headquarters for Analysis Research and Transparency (CHART), including a multi-criteria decision-making framework and a progress monitoring dashboard.”

Maine Plan Centers Community Broadband

Another key area where Maine’s plan differentiates itself is its explicit “support (for) public ownership models, including for municipal, regional, and broadband utility districts, enabling diversification of ownership structures in Maine.”

Though the infrastructure law specifically says states must allow municipalities, nonprofits and other political subdivisions to access BEAD funds, 17 states have monopoly-friendly preemption laws that either outright prohibit or erect difficult barriers to building publicly-owned, locally-controlled broadband networks. Maine is one of the few states in the nation that is taking aim at why high-speed Internet service (where it exists) is so expensive in the first place: a lack of competition, as most Americans are beholden to a monopoly or duopoly “choice” in service providers.

To that end, Maine’s plan specifically notes how it will support Broadband Utility Districts (BUDs), community-based organizations formed to build and operate broadband networks, which the plan notes “provide(s) an ownership model critical in helping enable regional scale impact for improved connectivity and digital equity in Maine.” Given the financial challenges of a sustainable rural broadband network, Maine recognized the importance of rural towns working regionally for shared network solutions.

“Success in removing barriers for BUDs will clear the way for diversification in ownership models for broadband in Maine, which can create competition and provide alternative ownership models for communities.”

BEAD Won’t Be Enough

However, the Maine plan isn’t all sunshine and rainbows, as the state’s broadband officials don’t think BEAD will be enough to completely erase Maine’s digital divide.

“MCA has estimated the cost of extending service of at least 100/20 Mbps to all of Maine’s remaining (as of December 2022) 92,553 unserved and underserved locations to be between $542 million and $900 million” Therefore, “at this time, it is unclear how much, if any, funding will remain for secondary BEAD priorities, such as providing connections for eligible Community Anchor Institutions (CAIs) or Multiple Dwelling Unit (MDU) deployment strategies.”

Still, the state recognizes that anchor institutions and MDUs are critical and therefore “MCA will work to leverage digital equity funds, (American Rescue Plan Act) ARPA programming, and Middle Mile funds where possible to address connectivity needs.”

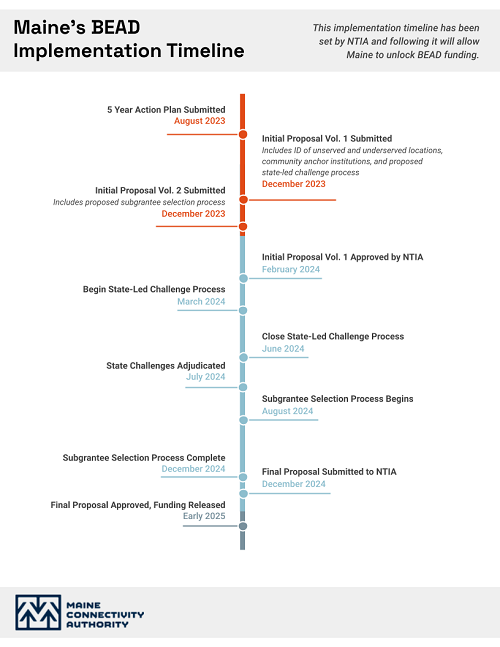

The public comment period for Maine’s Five Year Action Plan closed on June 30. Next up for Maine is the submission of its Initial Proposal. States have 270 days (nearly 9 months) from when it received its Initial Planning Funds to submit their Five Year Plans. The clock on when states must submit their Initial Proposals began at the end of June when NTIA announced how much each will get under the BEAD allocation formula.

States have about six months (180 days) from June 26 to file their Initial Proposals.

Louisiana

The state of Louisiana’s BEAD Initial Proposal intends to use its $1.35 billion BEAD allocation to ensure “that by 2029, every address will have broadband availability with speeds of connection up to 1/1GB per second as well as the capacity and digital skills necessary to accomplish common tasks.”

It’s a tall task given that 1.5 million Louisianians, or roughly one of every three residents, “do not have access to high-speed, affordable, and reliable [I]nternet,” most of whom live either in rural areas in the northern part of the state or on the southern coast of the state, which the proposal notes is “an area frequently afflicted by hurricanes that affect infrastructure as well as homes.”

The state’s plan makes it clear that broadband infrastructure in Louisiana “needs to be resilient to weather damage,” and therefore anticipates an approach that favors “burying fiber (especially in coastal areas) and building redundant systems (to) ensure fewer outages and improve emergency preparedness and response.”

Stemming the ‘Brain Drain’ in Louisiana

Louisiana’s Initial Proposal also goes on to note how ubiquitous high-speed Internet access is crucial for the state’s plan to invest in the "future of work activities" and will help to stem Louisiana's “brain drain” by building the digital infrastructure that will allow for “new jobs in areas such as cybersecurity, computer programming, telehealth, and artificial intelligence … for the first time.” Interestingly, the “brain drain” concern was a major motivation for LUS Fiber in Lafayette, which is the only municipal network in the state and has been under fire from big monopoly telecoms since before it was created.

As with the state’s previous broadband grant programs, the state will funnel its BEAD dollars into its Granting Unserved Municipalities Broadband Opportunities (GUMBO) program, as the state’s Office of Broadband Development and Connectivity (ConnectLA) is currently managing $176.7 million in Capital Projects Funds from the American Rescue Plan, which is expected to connect 88,500 homes and businesses in the next 12 to 18 months.

With ConnectLA laying the groundwork for GUMBO 2.0, the state’s BEAD proposal will “welcome the participation of any type of provider authorized to provide broadband service in Louisiana, including for-profit entities, co-operatives and public-private partnerships.”

The state is proposing to award grants in two rounds of funding “to maximize the number of areas receiving the benefit of both an initial funding request in Round 1 and a best and final request in Round 2.”

And while the state’s primary grant scoring rubric does not favor particular providers, “the secondary scoring criterion of local government/tribal support may favor certain applicants in certain areas based on clearly articulated local preferences from local governing authorities.”

To signal that ConnectLA means business, the proposal specifically notes that “if the provider has not (suitably) completed the project it was awarded through BEAD funds, the state reserves the ability to claw-back constructed assets and award them to another provider.”

BEAD ‘Sufficient’ for Louisiana but State’s Anti-Competition Law is a Problem

Unlike the uncertainty Maine has as to whether BEAD funds will be enough to connect all unserved and underserved locations, the Louisiana proposal says the state “anticipates that its $1.355 billion BEAD allocation is sufficient to reach all eligible locations in the state with (fiber-to-the-home) FTTH service,” although the state is “cognizant of the practical constraint that all eligible locations may not actually receive such an FTTH application.”

“To be clear, ConnectLA will always prefer a priority FTTH project unless the decision not to select a given FTTH project results in significantly more eligible locations receiving service from the best available technology…”

As it relates to affordability, Louisiana’s proposal not only notes the importance of the Affordable Connectivity Program (ACP), but also plans to use some of BEAD’s non-deployment funds to create “the Louisiana CASH Program,” which will offer an unspecified monthly subsidy for fixed wireline service and “will work in tandem” with ACP.

As one of the 17 states that have monopoly-friendly preemption laws in place, Louisiana’s proposal underscores the challenge the state will have with a law that “restricts public sector participation in broadband deployment.”

Known as “Local Government Fair Competition Act,” the law predates the BEAD program. And while it expressly permits local governments to provide cable television, telecommunications and/or advanced services, it “requires any local government seeking to do so to comply with certain requirements, such as conducting a feasibility study and engaging in a local referendum to ensure community buy-in.” The city of Lafayette built its municipal network prior to this current language, which was designed to ensure that no community could actually create the competition that the big monopolies have sought to prevent.

Unfortunately, for those eager to tap BEAD funds to help fund municipal broadband projects, the state plan notes that “Louisiana has decided not to waive the Local Government Fair Competition Act.” However, the proposal says, the recently passed state law (HB 653) that created the GUMBO program, gives the ConnectLA office the authority to create state rules and grant scoring criteria, further adding that the state’s Office of Broadband Development and Connectivity “intends to add criteria that incentivizes public sector participation through government support letters.”

This is not remotely close to what Congress called for in the text of the law, which specifically states that state plans must “ensure the participation of non-traditional broadband providers (such as municipalities or political subdivisions, cooperatives, non-profits, Tribal Governments, and utilities).”

The subsequent BEAD Notice of Funding Opportunity (NOFO) goes on to say that “NTIA strongly encourages Eligible Entities (states) to waive all such (preemption) laws for purposes of the Program. If an Eligible Entity does not do so, the Eligible Entity must identify all such laws in its Initial Proposal and describe how the laws will be applied in connection with the competition for subgrants (and), in its Final Proposal, disclose each unsuccessful application affected by such laws and describe how those laws impacted the decision to deny the application.”

In any case, Louisiana state leaders are eager to get all of its BEAD funding as soon as possible. The infrastructure law stipulates that states will receive at least 20% of its BEAD funds upon approval of a state’s Initial Proposal and then the rest when the final plan is approved. However, Louisiana’s proposal says, “per directives from Gov. Edwards, the Louisiana Legislature, and residents, ConnectLA is requesting an allocation of 100% to swiftly eliminate the digital divide by 2029.”

Residents and stakeholders in Louisiana still have until September 25 before the public comment period closes.

As state broadband offices swing into action, over the next several days, we will take a look at other states who have submitted their Five Year Plans and/or Initial Proposals and highlight key sections.

*This story has been updated with an updated BEAD timeline graphic

Header image of computer keyboard with ‘action plan’ button courtesy of Pix4Free, Attribution-ShareAlike 3.0 Unported (CC BY-SA 3.0)

Inline images of LUS Fiber fight story and Harvard study courtesy of LUS Fiber website