Fast, affordable Internet access for all.

This week on the podcast, Christopher is joined by Evan Marwell (CEO) and Jenny Miller (Director of Government Affairs), from the nonprofit Education Superhighway. Begun as an organization aimed at improving Internet access for schools, today Education Superhighway focuses its efforts on leveraging data and on-the-ground work to bring solutions for the more than 18 million households with basic broadband infrastructure available to them but for whom the price of connectivity is too high.

Evan and Jenny share more than a decade of work in working at the national, state, and local level to build tools like www.getacp.org, which simplifies the monthly subsidy application process, and their LearnACP program, which aims to train frontline workers signing individuals up. Finally, they talk with Chris about Education Superhighway's work to collect and publicize eRate contracts, which has helped create a more vigorous marketplace for school campus connectivity, dramatically lowering the price and increasing speeds for k-12 education centers.

This show is 30 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Arne Huseby for the music. The song is Warm Duck Shuffle and is licensed under a Creative Commons Attribution (3.0) license.

This week on the show, Christopher is joined by Stacy Evans, Chief Broadband and Technology Officer at BrightRidge, the municipal network for Johnson City, Tennessee. When last we spoke, the electric utility-powered network had just passed its first dozen homes. Three and a half years later, the municipal network has passed more than 10,000 premises. It returns more than $5 million per year to local goverment via payments in lieu of taxes (PILOT) (not to mention keeping electric prices low), and has driven both of the incumbent providers to increase speeds and lower prices. Christopher and Stacy talk about the value that's returned to the region, and how BrightRidge is only gaining steam - it's two years ahead of its build schedule, and using grants and Rescue Plan funds to reach thousands of households not accounted for in the original design, ensuring that as many people will get access to affordable, locally owned fiber as quickly as possible.

This show is 32 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Arne Huseby for the music. The song is Warm Duck Shuffle and is licensed under a Creative Commons Attribution (3.0) license.

This week on the podcast and on the most Valentines-iest of days, Christopher is joined by Katie Espeseth, Vice President of New Products EPB Fiber, at the municipal network in Chattanooga, Tennessee. After catching up on the release of the network's 25 gigabit service and the latest progress of the HCS EdConnect initiative (which has connected almost 10,000 homes), Katie shares with Christopher how its SmartNet Plus program expands the managed Wi-Fi framework to take advantage of the many devices we all have in our homes that connect to the Internet. The show ends with Katie and Christopher reflecting on how - thanks not only to Chattanooga, but the other cities as well as telephone and electric cooperatives in the state - Tennessee is among the best-connected across the country, with some of the fastest speeds and most affordable rates available.

This show is 29 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Arne Huseby for the music. The song is Warm Duck Shuffle and is licensed under a Creative Commons Attribution (3.0) license.

Dryden, New York, population 14,500, has formally launched the town’s municipal broadband network, becoming the first municipality in the state to provide residents with direct access to affordable, publicly owned fiber.

According to the Dryden Fiber website, the town now offers local access to fiber broadband at three speed tiers: symmetrical 400 Megabits per second (Mbps) for $45 a month, symmetrical 700 Mbps for $75 a month, and symmetrical gigabit broadband service for $90 a month.

The city’s pricing options are a dramatic improvement from the area’s regional cable monopoly Charter Communications, whose Spectrum-branded service has largely monopolized vast swath of upstate New York, leaving consumers saddled with high prices, spotty coverage, slow speeds, and some of the worst customer service of any company in America.

It’s also a dramatic improvement over the sluggish, expensive, dated Frontier DSL that peppers the green rolling hills of Tompkins County. After filing for bankruptcy for failing to upgrade its network to fiber, Frontier has promised improvements–but none of those improvements have found their way to rural upstate New York.

The full cost of Dryden’s municipal network is expected to be $15 million. The pilot area of the project—covering around 50 residences in the southwest part of the town—will be funded by a combination of $2 million in federal COVID-19 disaster relief funding, an Appalachian Regional Commission grant and an as-yet-unspecified number of bonds.

“We were motivated to study and build a municipal broadband system because residents were not satisfied with the options and service provided by commercial ISPs,” Dryden Town Supervisor Jason Leifer told ILSR.

“In 2019 we commissioned a study and found that we could offer the service with newer technology and better pricing over the long term,” Leifer said. “90% of respondents to our household survey supported the project. Dryden was ahead of the curve on the broadband issue because we knew prior to COVID that access to reliable and affordable high-speed internet service is a necessity for our residents.”

Like countless U.S. communities, the pandemic highlighted the essential need for uniform, affordable access, something both Spectrum and Frontier consistency refused to provide, Leifer said.

This week on the podcast, Christopher is joined by Shayna Englin, Director of the Digital Equity Initiative at the California Community Foundation (CCF) to talk about a new report by CCF and its partners that reveals the systematic broadband cost inequities perpetuated in LA County by Charter Spectrum, the region's monopoly provider. "Sounding the Alarm," a pricing and policy impact study, shows not only that economically vulnerable households in Charter Spectrum territory pay more for slower service than those in wealthy neighborhoods, but that they are also saddled with worse contracts and regularly see fewer advertisements for the monopoly provider's lowest cost plans.

The result, Shayna shares, is that the higher poverty neighborhoods (often predominantly populated by households of color) often pay from $10 to $40/month more than low-poverty (often predominantly populated by white households) for the exact same service. Christopher and Shayne talk through the implications of these findings, and the report's call for policy changes to address Charter Spectrum's practices. They end the show by talking through some of the upcoming broadband infrastructure rules at the state level aimed at improving access and competition.

This show is 35 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Arne Huseby for the music. The song is Warm Duck Shuffle and is licensed under a Creative Commons Attribution (3.0) license.

This week on the podcast, Christopher is joined by two representatives from Pharr, Texas (pop. 79,000), which has embarked on a citywide fiber-to-the-home (FTTH) network build that is seeing strong local support and fast progress in recent months. Jose Pena is the IT Director for the city, and and Guillermo Aguilar works as a Partner at Brownstone Consultants, which is serving as a project manager for the network build. Jose and Guillerma talk with Christopher about the impetus for TeamPharr, the municipal effort which formally kicked off in 2017 with a feasibility study.

Jose and Guillermo share how the city moved to a fixed wireless pilot project on the southern part of town a few years ago before extending the network to a collection of city parks and then making the commitment to a full citywide buildout in 2020. They detail their early work in the state, which places some barriers in front of communities looking to take their telecommunications future into their own hands, and the help they got from Mont Belvieu (which also runs its own network). Jose and Guillermo share the phenominally fast progress the team has made, from finishing the design phase in September of last year, to connecting the first household in January 2022, to passing 70 percent of premisestoday.They also talk about their work to offer subscribers low pricing tiers ($25 and $50/month for symmetrical 500 Mbps and gigabit service, respectively) and their efforts to help households sign up for the Affordable Connectivity Program.

Check out the videos at the bottom of this story for more about why Pharr undertook the project and the progress the city has made so far.

This show is 40 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Arne Huseby for the music. The song is Warm Duck Shuffle and is licensed under a Creative Commons Attribution (3.0) license.

Join us live on Thursday, August 25th, at 5pm ET for the latest episode of the Connect This! Show. Co-hosts Christopher Mitchell (ILSR) and Travis Carter (USI Fiber) will be joined by regular guests Kim McKinley (UTOPIA Fiber) and Doug Dawson (CCG Consulting. They'll dig into recent news - from Starlink announcing uncharacteristic price drops to "to reflect parity in purchasing power across our customers," to big cable companies and telcos going after BEAD grants, to a reflective look on how well (or not) we did with the broadband stimulus.

Email us broadband@muninetworks.org with feedback and ideas for the show.

Subscribe to the show using this feed or find it on the Connect This! page, watch on YouTube Live, on Facebook live, or below.

Join us live on Thursday, August 25th, at 5pm ET for the latest episode of the Connect This! Show. Co-hosts Christopher Mitchell (ILSR) and Travis Carter (USI Fiber) will be joined by regular guests Kim McKinley (UTOPIA Fiber) and Doug Dawson (CCG Consulting). They'll dig into recent news - from big cable companies and telcos going after BEAD grants, to the announcement of 25 Gigabit per second service across the footprint of Chattanooga's municipal network, to the future of streaming video, to a reflective look on how well (or not) we did with the broadband stimulus.

Email us broadband@muninetworks.org with feedback and ideas for the show.

Subscribe to the show using this feed or find it on the Connect This! page, watch on YouTube Live, on Facebook live, or below.

In a release today, the Federal Communications Commission (FCC) announced it was voiding applications by two of the biggest Rural Digital Opportunity Fund (RDOF) bidders from December 2020. This includes more than $885 million for Low-Earth Orbit (LEO) provider Starlink and more than $1.3 billion for LTD Broadband, Inc.

LTD’s original winning bids are spread across 15 states, but there has been speculation brewing since late last year from industry experts as to if funds would be released at all. We’ve seen 12 releases from the FCC since late winter authorizing funds for most of the winning bidders (from the monopoly providers to consortia of rural electric cooperatives), which we’ve collected in our Rural Digital Opportunity Fund Dashboard here. Conversely, there has been relatively little conversation about why Starlink had not yet received any of its winning bids.

Skepticism about Speed, Deployment and Cost

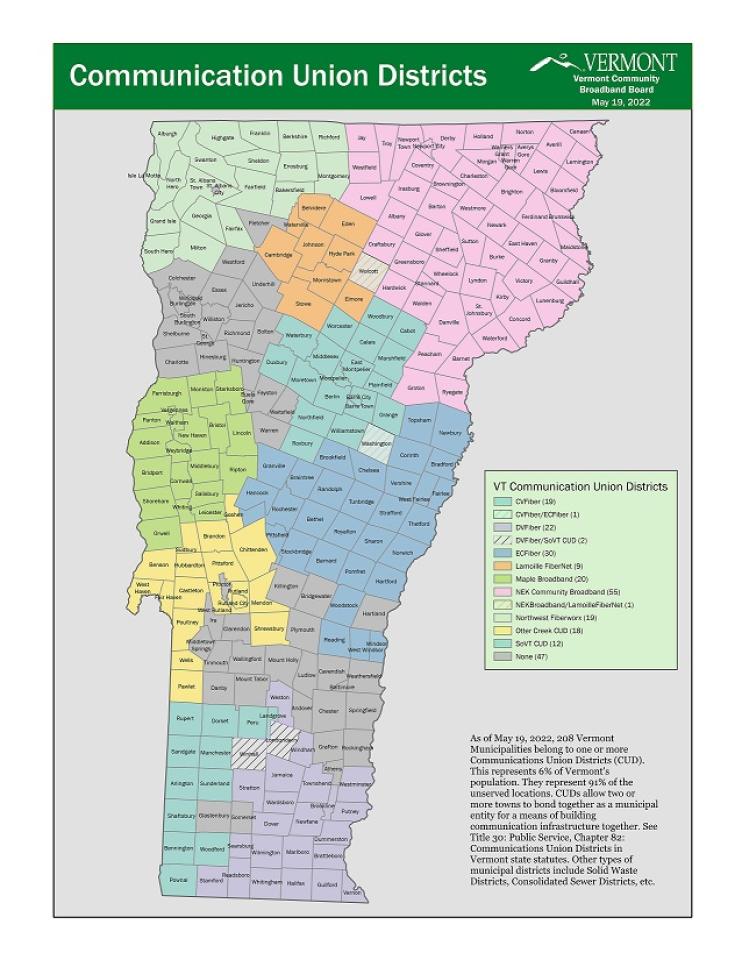

NEK Broadband has been awarded a $16 million grant by the Vermont Community Broadband Board (VCBB) to expand fiber access to 10 new Vermont communities. It’s among the earliest of what is likely to be a flurry of activity by the mostly-newly created Communications Union Districts - partnerships between rural cities and towns - which have formed over the last few years to solve the connectivity crisis for the tens of thousands of Vermonters who have been left behind by the current broadband marketplace.

A New Approach

Vermont’s broadband policy leaders say they plan to embrace CUDs as the primary avenue by which they hope to bridge the state’s long standing digital divide. A significant portion of the state’s $150 million broadband package will be funneled toward CUDs in a state where 85 percent of municipalities and 90 percent of underserved locations fall within a CUD.

The formation of most of the state’s CUDs is relatively new, though the most veteran example (EC Fiber) formed more than fifteen years ago. After years of persistence by EC Fiber, determined progress, and attitudinal changes in policy at the state level, CUDs now sit at the heart of the state’s rural broadband efforts.